BRBH offers a choice of two Anthem medical plans for Full Time employees.

Employee Benefits

MEDICAL INSURANCE

Base Plan

Our base plan is an Anthem High Deductible Health Plan (HDHP). This plan has a very low premium and an annual deductible that applies to your medical and prescription drug benefits. After the deductible is met, you only pay a percentage coinsurance for covered services.

BRBH contributes to a Health Savings Account (HSA) $540/annually for individual coverage or $720/annually when also covering dependents. You may also contribute pre-tax!

Premium Plan

Our premium plan is the Anthem Point of Service. This plan has a higher level of coverage. Doctor’s visits and prescriptions are billed by a set co-payment. After the low deductible is met, you pay only a percentage coinsurance for covered services.

Employees can contribute pre-tax to a Flexible Spending Account (FSA) for medical expenses!

DENTAL INSURANCE

BRBH offers a choice of two levels of dental coverage through Delta Dental.

Preventive Dental

This plan has a low premium and includes basic dental coverage that only covers routine oral exams, cleanings twice per year, x-rays, and sealant/fluoride treatment for children. This coverage does not require any copayments or deductibles.

Comprehensive Dental

This plan has a much higher level of coverage and includes diagnostic and preventative services, primary dental care, major dental care and orthodontic service.

VISION INSURANCE

BRBH offers low cost vision coverage through Anthem Blue View Vision that includes premium coverage for eye exams, frames, lenses, and contacts.

RETIREMENT

Virginia Retirement System (VRS)

Full-time employees of BRBH are members of the Virginia Retirement System (VRS). In addition to the 5% employee contribution, BRBH contributes and additional equivalent of 1.53% of your wages.

Deferred Compensation (457 Plan)

You may also supplement your retirement savings by contributing to a 457 or ROTH plan.

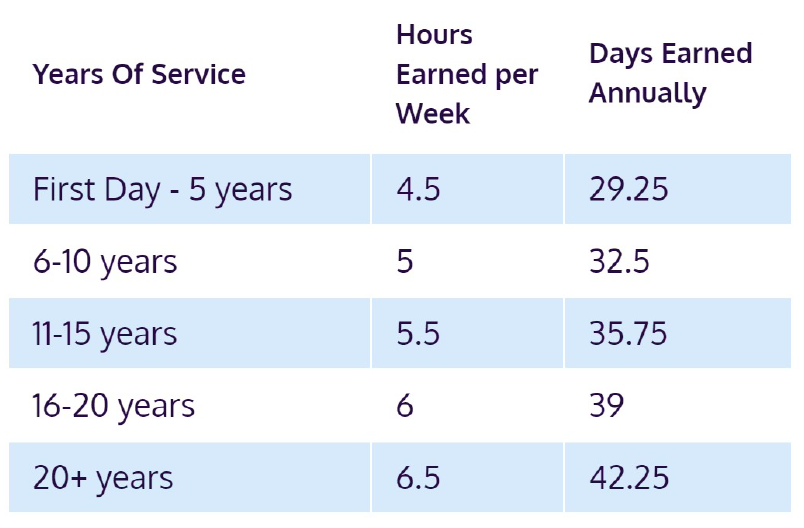

PAID TIME OFF

BRBH provides Paid Time Off (PTO) for vacations, holidays, public closings, personal and family illness & personal business.

FREE INCOME PROTECTION PLANS

Life Insurance

Life insurance equivalent to two times your annual wages is provided for free! Additional life insurance is available at a low group rate, with coverage up to 8 times your annual wages.

Short and Long Term Disability

Short-Term and Long-Term disability coverage is provided at no cost to employees.

BRBH’s Disability Plans provide a significant percentage of your weekly income during a serious illness or accident to help pay bills and assist your in maintaining your current lifestyle during your time of disability. Depending on the severity and length of your illness or accident, you could possibly receive approved disability benefit payments until you reach your normal retirement age.

PROFESSIONAL BENEFITS

Licensure Supervision

BRBH provides free licensure supervision for those requiring clinical licensure as part of their job requirements (LPC, LCSW, or CSAC). We prioritize supervision and you will meet with potential supervisors in your first two weeks.

Liability Insurance

BRBH provides liability insurance on all employees for work activities during the hours for which they are both on duty and paid by BRBH. The amount of general liability coverage for each employee is $4 million per occurrence and $2 million for each malpractice occurrence with unlimited aggregate. Liability insurance is available to all employees.